When it comes to your money, the first rule of thumb is that you need to own your finances. Your money, your rules, right? But in order to be confident with your finances, you need to develop some basic financial habits so that you’re in control of your money — rather than your money be in control of you.

From creating a budget to avoiding lifestyle inflation, we’re covering 11 financial habits you need to master for financial success. Keep reading and let’s get right into it!

11 Financial Habits You Need to Master

1. Track your money

First things first: track your money. This means knowing exactly how much money you’re bringing in, and how much money you’re spending. And I’m talking about getting real nitty gritty here. Get into the habit of tracking literally every dollar you make and spend. How much money did you earn last month? What did you spend on groceries? How much did you save?

If it feels like too much – think about it. Every single dollar you make, is money that you’ve earned with hard work, blood, sweat, and tears. (Okay, hopefully not blood and tears, but hard work for sure.) Just like you’d pay attention to anything else important in your life, don’t forget to pay attention to your money too.

If you need some help with getting this all down on paper, then get your free copy of our Money Moves Toolkit here. The toolkit has trackers and sheets for you to record all of your money habits.

And if you’re ready to take things to the next level, check out our Monthly Budget Template for Google Sheets. This spreadsheet will help you track your money with a clear breakdown of expenses, income, debt, and savings month-over-month.

2. Live below your means

One of the financial habits that’s always up for debate: live below your means. In order to master your finances, it’s important for you create a lifestyle that doesn’t require you to spend all the money you bring in. Meaning, if you’re bringing in $3000 a month, you can’t be living on $2999.99 worth of expenses each month. Your expenses should be well below your total income so you don’t create a paycheck-to-paycheck lifestyle. This one’s tough of course, but that’s where avoiding lifestyle inflation and creating a practical budget comes in – which we’ll get to shortly.

3. Pay yourself first

You’ve heard this once, you’ve heard this twice, and here I am repeating it for the tenth time — because it’s just that important. You have to pay yourself first.

Otherwise known as the reverse-budgeting method, this is where you start by allocating an amount to save or invest each month for your future and financial freedom, and then allocate the rest of the amount towards your expenses.

What you don’t want to do is create a lifestyle where you’re saving whatever is left over (if anything) after you’ve spent all your hard earned money. There’s nothing worse than working for years on end, only to have nothing to show for it in your account. Pay yourself first and your future self will thank you.

4. Create a budget

And stick to it. Enough said. Probably the foundation of all financial habits you need to master, creating a budget is key to sticking to your financial goals. Think of it as the playbook to your financial life. It dictates the rules, keeps you in line, only to make sure you’re coming out net positive on the other end. Without a budget, it’s pretty tough to take control of your finances.

Shop the Monthly Budget Template for Google Sheets

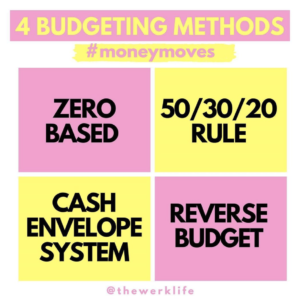

A budget helps you set boundaries around how much you can and should be spending based on your income. There are a lot of different ways to budget, and there’s no right or wrong. Create a budget according to your style and current situation. Some great examples of budget frameworks include the 50/30/20 rule, the reverse-budgeting method (as mentioned above), the zero-based budget, and the cash envelope system. Check out our post on Instagram for a quick recap of each one! (Also, be sure to follow us on Instagram for more great financial tips and general life hacks!)

5. Don’t borrow to live

Building good credit is extremely important, there’s no doubt about that. But what you don’t want to do, is create a life where you’re dependent on credit, and you’re borrowing to live.

When used carefully, credit is a necessary tool to help build your financial future. That being said, credit has to, and I repeat, HAS TO, be used so attentively. Simple rule of thumb: if you don’t have the cash in your debit account to pay for whatever you’re purchasing on credit, don’t buy it. Rather than using credit as a means to purchase the things you can’t afford, use credit as a tool. If you’re putting something on credit, pay it back before your statement is due so that you can (1) avoid interest, (2) build up your credit, (3) avoid the stress of built up debt, and (4) create good financial habits.

6. Start investing

Next on our list of financial habits…investing. What if I told you that your money could work for YOU, and that you didn’t have to work for your money?

You probably wouldn’t believe me, right?

Well – allow me to introduce you to your new BFF, and a basic investment term you oughta know: compound interest. In simple terms, compound interest is the concept of your money making money, (which we’ll call interest), and that interest, making you even more money. In other words, the core concept of investing.

With investing, comes wealth, which is why it’s an important factor when it comes to your financial planning. For more info on investing, check out the read below.

Read: Investing 101: Why You Need to Start Investing ASAP

7. Set financial goals

In order to build wealth, you need be clear on what you’re trying to build towards. Do you want to achieve a certain income? Are you striving to pay off your debt by a certain period of time? Is there an ideal net worth you’re hoping to hit?

Set some financial goals and write them down. Set up an action plan to determine how you’re going to get there, and keep yourself accountable.

Remember, sky’s the limit – so don’t sell yourself short when setting your financial goals!

Read: How to Set Goals and Actually Achieve Them

8. Avoid lifestyle inflation

A parallel to financial habit #2 (live below your means); avoiding lifestyle inflation is one of those financial habits that’ll really pay off in the future.

So you might be thinking, lifestyle inflation? WTF is that? Fair question, my friend!

Lifestyle inflation, otherwise known as lifestyle creep, is when we start to spend more money on luxuries that we perceive as needs, although there’s no direct value add to our lives. In other words, as we start to increase our income, we spend more money on things we normally wouldn’t spend it on, just because we can. It’s a little bit of Keeping Up with the Joneses meets Get Rich or Die Tryin’.

Lifestyle inflation can catch up with you real quick, so evaluating your budget and staying close to your financial goals is key as you start to earn more income.

9. Hedge yourself with an emergency fund

Regardless of your current income level, how much debt you have, or whatever financial situation you’re in – you need an emergency fund.

Think of your emergency fund as a rainy day fund – an amount of cash that’s liquid and that you can easily access, well, in case of an emergency. Maybe that’s a sudden job loss, a broken furnace, unexpected car repairs – the list goes on. Whatever the case is, you’ll always want a lump sum of cash that you can pull on if needed.

A good amount to start with is $1000, and overtime you should build that amount to cover 3-6 months of your living expenses.

$1000 might seem like a lot right now, but small steps add up to bigger ones, so start putting away what you can and you’ll be surprised at how fast you can save for an emergency fund.

Read: What is an Emergency Fund, and How Do I Save for One?

10. Educate yourself on personal finance

The wisest of the financial habits – always keep learning. Your personal finances are never a one and done. Money comes, money goes. There are always new opportunities to earn, save, invest, and more – so keep yourself educated on personal finance.

Whether that’s reading a new book on personal finance every year, or doing research on ways you can get better with your finances – don’t stop learning.

I have a hunch you’ve already got this financial habit in place… after all, you are here reading this, right? 🙂

Keep up the great work and continue the self-learning!

11. Review your finances regularly

Last but not least, review your finances on the regular. Bringing us back full circle to the first financial habit (track your expenses), doing a financial review routinely is so important for your financial success.

Here are some things you should be reviewing, at a minimum, on a monthly basis:

- Total income you brought in

- Expenses for the month

- Your current budget – is it working or do you need to adjust?

- Debt repayments – status and amount outstanding

- Emergency fund status

- Investment accounts

- Upcoming expenses and income

Again, if you need some help with getting this all down on paper, then get your free copy of our Money Moves Toolkit here. And if you’re ready to take things to the next level, check out our Monthly Budget Template for Google Sheets. This spreadsheet will help you track your money and take control of your personal finances with a clear breakdown of expenses, income, debt, and savings month-over-month.

So, whether that’s reviewing your finances once a week, or committing to do a deep review at the start of each month. Always, make time for your money.

Read: 5 Important Things to do at the Start of Every Month