The benefits of investing your money sooner, rather than later.

Let’s be real. There are plenty of things in life we all procrastinate on. We put things off, and say “not now, tomorrow” way more often than we should. If investing is one of those things that you’ve been putting off – then girl, we’ve gotta talk.

Investing doesn’t need to be boring, complicated, or confusing. In fact, when you learn just the basics of investing, you’ll discover a whole new side of your money game that you would have never known before.

So, if you’re someone that tunes out the moment someone starts talking stocks, bonds, or the market – keep reading to find out just what you’ve been missing out on!

1. Put your money to work

What if I told you that your money could work for YOU, and that you didn’t have to work for your money?

…you probably wouldn’t believe me right?

Well – allow me to introduce you to your new BFF, and a basic investment term you oughta know: compound interest. In simple terms, compound interest is the concept of your money making money, (which we’ll call interest), and that interest, making you even more money.

Sounds too good to be true, doesn’t it? Let’s walk through an example.

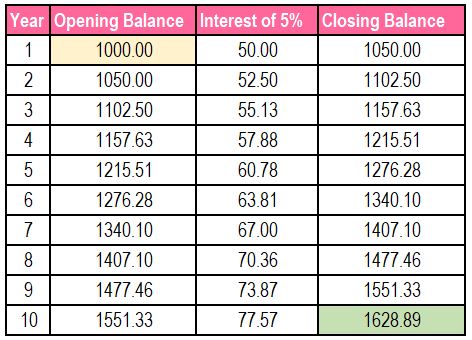

Let’s say you invest $1000 in a fund that gives you a 5% return annually.

In Year 1, you’ll make $50 interest on the $1000. So, your balance at year-end, will be $1050.

In Year 2, you’ll make 5% interest not on that $1000, but instead, on that $1050, which is $52.50. Your new ending balance for the year would be $1102.50

In Year 3, you’ll make 5% interest on the $1102.50, which is $55.13. Meaning your year-end balance in year 3, would be $1157.63.

Your money will continue to grow quickly and exponentially, thanks to our good friend, compound interest.

So, if you left that $1000 in a regular chequing account, without investing, you would have made no interest, and came out 10 years later with that same $1000. Instead, if you had invested it in a fund with an approximate 5% growth, you’d be looking at an extra $600 in your pocket! (Assuming of course, your 5% growth is consistent and constant).

2. You can take on more risk when you’re younger

Across the spectrum of “investment types” there are a range of vehicles that span from being not so risky, to really risky. The riskier your investment, the higher the return.

An example of a high risk investment could be a share of a company / a stock, and an example of a low risk investment could be a bond, or a GIC.

When you start investing at a young age, assuming that you’ll be putting your investments away for the long-term, you technically have a higher tolerance for risk. When you hold riskier investments for a longer time span, you give it enough time to withstand the ups and downs of the market.

In other words, your investments can withstand a bit of volatility when you’re younger – so take advantage of that ability to take on more risk, which’ll give you a higher return in the long-run.

3. Retire earlier

Need I say more?

The sooner you start investing, the sooner your money starts growing, and thanks to our newly introduced friend (compound interest), you make a lot more moolah a lot faster, which all in all = retiring sooner.

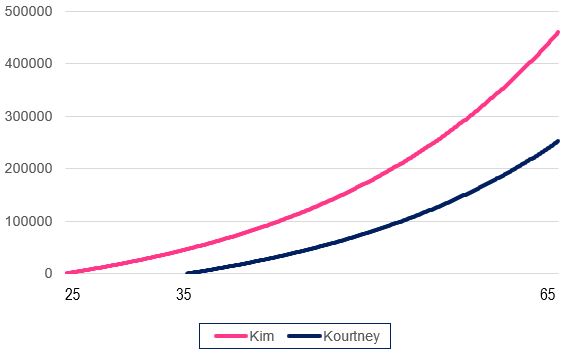

Let’s take a look at Kim and Kourtney – who started investing 10 years apart.

Kim started investing at age 25, putting away $300 a month at a 5% annual interest rate, and Kourtney started putting away $300 a month at the same rate but at age 35. By waiting another 10 years, here’s just how much Kourtney will have missed out on by the time she’s 65:

Assuming a constant return of 5%, waiting another 10 years to invest cost Kourtney about $200,000.

Moral of the story?

Kim always wins. Start investing now. ‘Nuff said.

4. Be a boss with your money

There’s no doubt that the moment you start investing, you’ll spark an interest in your finances like never before.

Where you might have once seen money as a thing that comes and goes and is deposited into your bank account every few weeks; the moment you start investing, your perspective will completely change.

You’ll soon see the “other side” of money: how to stop working for your money, and instead, make your money work for you.

Want to learn more about investing? Check out The Young Professional’s Guide to the RRSP.

Hahha @ Kim always wins.

Really good article. You broke it down into the simplest of concepts. Most people don’t realize how even the smallest amount can make all the difference. Start saving just a little, whatever you can afford, even if it is just $10 a month. Swear to yourself not to touch it, and slowly but surely, over time, you’ll have some money put away.